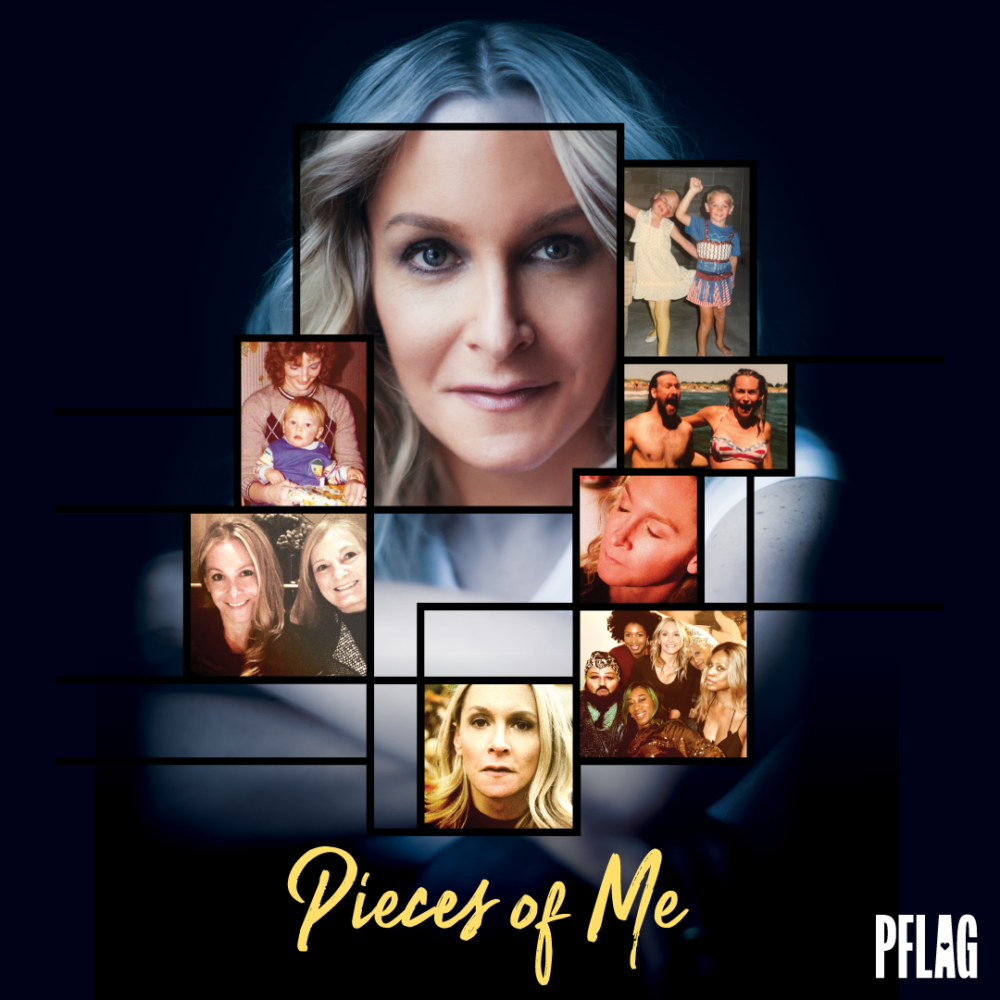

New Short Film "Pieces of Me"

Our newest film "Pieces of Me" is out now in honor of Transgender Day of Visibility!

Written, directed, and produced by Nick Oceano-Armendariz—the film centers on the life of New York-based artist and transgender activist Joslyn DeFreece.